Mountain Pass: America’s Once and Future Rare Earth King

Mountain Pass, California once produced the majority of the world’s Rare Earth Elements (REEs). The 2002 closure of the mine effectively handed China control of the global REE supply chain. Recent years, however, have seen major private and government investments which have revived both Mountain Pass and hopes of a secure REE supply chain.

Overview

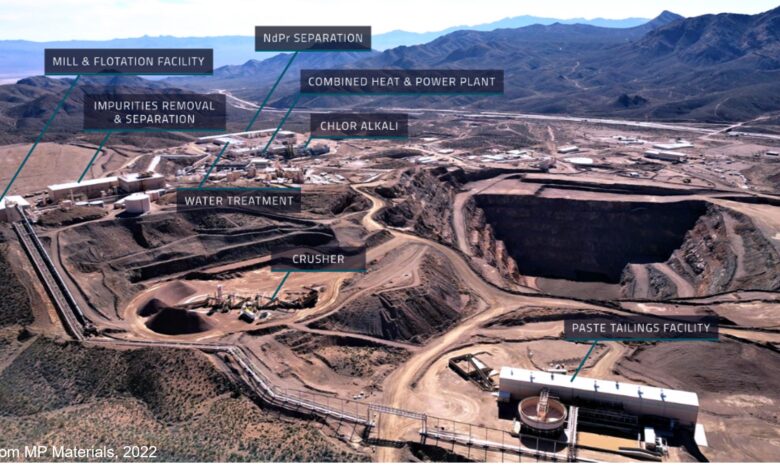

Mountain Pass is an open pit mine located in a remote corner of the California desert 85 Km southwest of Las Vegas, Nevada. Although estimates of proven and probable resources vary, most place them at least 18.4 Mt at 7-9% rare earth oxides, making it a truly world class deposit. The mine is owned by MP Materials, which in turn is 52% owned by American hedge funds JHL Capital Group (including its CEO’s shares) and QVT Financial LP, with the Chinese firm Shenghe Resources Holding Co. Ltd holding an 8% stake. The project is adjacent to a major highway and has access to rail and port infrastructure.

Rare Earth elements are a group of elements near the bottom of the periodic table, the lanthanide series, plus a few others such as yttrium and scandium, which are typically included due to similar chemical properties. Despite their name, rare earths aren’t particularly rare, but their chemical behavior means they rarely form minable deposits and makes them very hard to process and refine. REEs are often divided into light rare earths (LREEs) and heavy rare earths (HREEs), with HREEs being much rarer and more valuable. REEs are essential for many high-tech products from consumer electronics to wind turbines to defense technologies.

While REEs are often divided into light and heavy, exactly where the division is drawn varies with source.

China currently controls >80% REE production, processing, and manufacture of many REE-based components such as high strength magnets. This situation was recognized as threat to national security after China abruptly suspended REE exports to Japan in 2010 in a move which was widely seen as politically motivated.

Mountain Pass currently produces 38500 t/yr of rare earth concentrate, about 15% of global supply. Mountain Pass is focused on producing high-purity Neodymium-praseodymium oxide, a key ingredient in the high strength permanent magnets which are vital for many modern electronics. This concentrate is currently shipped for processing in China; however the mine’s processing facility is currently being recommissioned and is expected to be complete in the near future. This facility will be the only large scale REE processing facility in the western hemisphere and will use proprietary new technology that will supposedly be far more economical and environmentally friendly than previous techniques. The cooccurrence of radioactive elements uranium and thorium in most REE deposits, as well as the use of toxic chemicals in REE processing has previously made it difficult for western producers to meet environmental standards at a cost competitive with Asian projects.

Geology

Mountain Pass formed 1.4 billion years ago, when a carbonatite, a rare and often REE-rich igneous rock consisting of greater than 50% carbonate minerals, intruded into the area’s gneissic rocks. The main ore body is the Sulfide Queen carbonatite, although many smaller carbonatites and other igneous rocks are associated with the deposit. The main ore mineral at Mountain Pass is bastnaesite (a REE-carbonate-fluoride mineral), with calcite, dolomite, and barite being the main gangue minerals.

Bastnaesite is a desirable REE ore, as it is relatively easy to process.

The origin of carbonatites is still debated, but they are thought to have their roots in the mantle, hundreds of kilometers below ground. Carbonatites are rich in volatiles such as water, carbon, and fluorine, which give them a very low melting temperature which may allow them to be effectively distilled out of hydrothermally altered (metasomatized), volatile-rich areas of the mantle. They may also be formed through immiscibility when carbonatite melts spontaneously separate from more common silicate melts in a process similar to oil droplets separating from water. Yet another theory imagines carbonatites as the residual liquid left over after large amounts of silicate minerals crystalize from certain alkaline silicate melts. Most carbonatites are found in areas where the continental crust is being pulled apart (rifted), which is known to encourage melting of the underlying mantle.

Exactly how carbonatites concentrate REEs so effectively is uncertain, but it likely involves their unusual volatile rich and highly alkaline chemistry, which is known to favour concentration of REEs. Their richness in fluorine, in particular, may help REEs stay in the melt while other elements crystalize out, eventually concentrating them to ore grades in the remaining magma.

History

Mountain Pass was discovered in 1949, and was swiftly acquired by Molybdenum Corporation of America, with small-scale production beginning in 1952. Production was massively expanded in the mid-1960’s, driven largely by demand for the element europium, which was used in the fancy new colour TVs of the time. The mine produced the bulk of global REEs from the 1960s-1990s, during which time Molybdenum Corporation changed its name to Molycorp and was acquired by Union Oil. Increasing competition from low-cost Chinese producers and environmental issues caused the mine’s fortunes to wane rapidly in the late 1990’s.

Mountain Pass’s processing facility produced slightly radioactive wastewaters containing uranium and thorium, and spills of this wastewater led to a lawsuit from the county that resulted in costly fines and an order to clean up the spill site. Poorly regulated Chinese competitors faced no such issues. There was plenty of ore left, but with high costs, increasing environmental liability, and little public support, Mountain Pass had become unprofitable and closed in 2002.

Mountain Pass once dominated global REE production.

In 2008 the project was sold to Molycorp Minerals LLC, a privately held company which planned to invest $500 million to reopen and expand the mine. All seemed to be going well as Molycorp raised $400 million in its’ 2010 initial public offering, with mining recommencing in August 2012. This revival would prove short lived, however, as Molycorp struggled to perfect its new, more environmentally friendly processing technology. Molycorp filed for bankruptcy in June 2015.

MP Minerals acquired Mountain Pass out of bankruptcy in 2017, with mining once again recommencing in 2018. In February 2022 the US Department of Defense (DoD) announced it had signed a $35 million contract with MP Materials to build a HREE processing plant at Mountain Pass. The contract is part of a larger DoD program aimed at securing a domestic REE supply chain.

Can Mountain Pass secure the global REE supply chain?

With enormous reserves of high-grade ore and large-scale production, on paper Mountain Pass has the potential to make a real impact on global supply chains. Mining REEs, however, is the easy part; refining these elements, which are very difficult to separate due to their many shared chemical properties, is the more complex, expensive, and potentially environmentally damaging task.

The impending opening of the Mountain Pass’s processing facility is more significant than the mine itself. If the improved processing technology works as advertised it would demonstrate that refining REE ores into usable products is economically viable in the western hemisphere, potentially paving the way for other projects. If MP Materials faces the same difficulties as Molycorp, however, it may spell trouble for the entire project.

Although the project’s checkered history suggests that it may face difficulties sustaining production, the influx of private and government investment makes this reopening seem more permanent. Mining and processing REEs is no longer just a matter of economics, it’s been recognized as a matter of national security as well. Government intervention, defense in particular, has a way of changing a project’s fortunes.

Mountain Pass, however, is not a silver bullet in securing a supply of REEs. Like most carbonatite deposits, Mountain Pass’s resources are heavily weighted towards LREEs, and it’s unclear how much HREEs it can produce. The bulk of Mountain Pass’s REEs are the relatively common and oversupplied elements lanthanum and cerium. This has led some to suggest that Mountain Pass is less relevant than investors have claimed, and that putting so much emphasis on the project has diverted resources that might’ve been better spent on developing other projects. It should also be noted that while the project is majority American-owned, a Chinese firm still holds a sizable piece of the project.

For the time being, China will continue to dominate production and processing of REEs, with its relatively unique, HREE rich ion adsorption clay deposits giving it a particularly large advantage in HREEs. Building a truly secure REE supply chain will require far more than reopening a single mine, however large it may be.

Conclusion

The reopening of Mountain Pass and development of new REE processing facilities marks a major step in securing the strategically and economically important REE supply chain. Provided the long-awaited new processing technology actually works as advertised the mine’s large reserves of high-grade ore and integrated processing facility will make it a significant source of American LREEs for many years to come.