Gallium: The Unicorn of Critical Mineral Deposits

When you think of critical minerals, you probably think of lithium or cobalt, but some of the most threatened minerals are ones you may not have heard of. One such element is gallium (Ga). This elusive metal has been a recent victim of the simmering trade war between China and western nations, triggering a price surge. With no primary gallium mines in existence, can new sources be found?

What is Gallium?

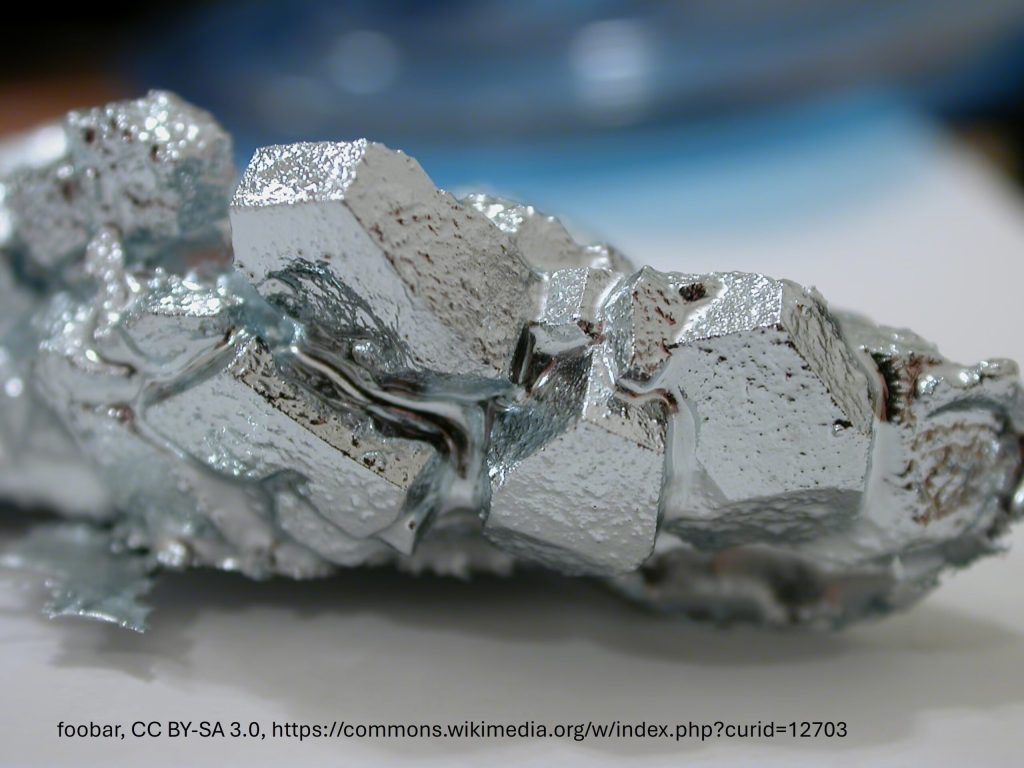

Gallium is a soft, silvery white metal with a melting point similar to chocolate; it melts in your hand. Gallium is used in low-melting-point alloys, but its’ main use is in gallium nitride semiconductors, key components of many high-tech devices such as cell phones, LEDs, switches, fiber optic cables, solar panels, and many others. The internet signal you’re using to read this article may well be made possible by gallium. Gallium nitride is also vital to many advanced missile systems, notably Patriot missiles, one of the few effective defenses against increasingly deadly long-range missiles.

A crystal of silvery gallium metal.

In August 2023 China, which produces 98% of all refined Ga, imposed export restrictions in a move widely seen as retaliation for American restrictions on computer chip exports to China. The result has been a sharp rise in Ga prices and fears of a shortage. Disruptions to aluminum refining have also caused sudden supply shortfalls and price spikes in the past. Gallium has been listed as the number one supply risk to national security.

A Threatened Supply

If you Google ‘gallium deposit’ the AI will tell you there is no such thing. Gallium isn’t particularly rare; it has an abundance in the crust of about 19 parts per million (ppm), making it slightly more common than lead. The problem is that gallium’s physical and chemical properties make it almost impossible to concentrate to ore grades through any known geological process. Although gallium minerals such as gallite (CuGaS2) do exist, the metal mostly substitutes for aluminum, or more rarely zinc, as mere impurities in more common minerals. Gallium is widely dispersed throughout rocks of all types, but almost nowhere is it concentrated enough to extract.

Today 80% of the world’s Ga is extracted at very low levels (~50 ppm) as a byproduct of bauxite (aluminum) mining, with the rest produced as a byproduct of zinc mining. In theory plenty more should be available, it’s estimated that only 10% of Ga potentially recoverable from aluminum mining is currently extracted. The difficulty is that this small amount of gallium is far less valuable than the large amount of aluminum, and such a small revenue stream may not justify the capital expense building the required infrastructure. Even a steep rise in Ga price might not change this. Gallium supply is largely at the mercy of bauxite production and does not increase to match demand. World Ga production is estimated at only ~320 tonnes.

Bauxite (AlOOH) (left) and sphalerite (ZnS) (right) are the main “ores” of gallium, despite containing only traces of the metal.

To make matters worse the technology used to extract Ga from bauxite in China likely wouldn’t be viable in western nations due to labour costs and environmental issues.

Apex: A Unique Resource?

Only one primary gallium mine has ever operated: the Apex mine in Utah. Apex, owned by Teck, is considered to be a rare Kipushi-type carbonate-hosted lead-zinc deposit. These deposits are known to be unusually rich in Ga, mostly in the form of gallite, and the even rarer element germanium (Ge). Apex gallium and germanium ore, however, required an additional stage of supergene enrichment. When the sulfide ore was exposed to oxygen the sulfide minerals broke down, releasing the gallium which became concentrated in the iron sulfate (jarosite; KFe3(SO4)2(OH)6) and oxide (limonite; Fe)(OH)·H2O) minerals which replaced the sulfides. Gallium substitutes for iron in these minerals or is adsorbed onto mineral surfaces.

Apex operated intermittently for decades, mining at average grade of ~320 ppm Ga and 640 ppm Ge before it closed in 2011. The USGS estimates it still contains 79 tonnes of gallium.

New Sources on the Horizon?

The Cordero Deposit, Nevada, not to be confused with the Cordero silver deposit in Mexico, is possibly the only primary gallium project with a well-defined resource (15 Mt at 47.7 ppm gallium). Gallium mineralization here is associated with low-sulfidation epithermal silver-mercury deposits, with Ga hosted in alunite (KAl(SO4)2(OH)6) and other aluminous phosphate minerals. Cordero is owned by Silver Predator, who has mainly explored the property for precious metals. Cordero has been largely inactive since 2009.

Besides Apex and Cordero, the best bet to secure new, higher grade gallium supplies may be to ramp up rare earth element (REE) mining.

Round Top, Texas, (a joint venture between Texas Mineral Resources Corp and USA Rare Earth) is a rhyolite intrusion enriched in a wide range of rare elements, especially much sought-after heavy REEs. These are hosted mainly in fluorite (CaF2), with REEs substituting for common calcium, as well as an assortment of other minerals such as zircon (ZrSiO4). Rare metals were enriched in the primary magma, but also appear to have been further concentrated by late hydrothermal fluids. REE grades are around 500-600 ppm, while Ga grades are approximately 44 ppm. This may be low, but Round Top’s enormous size, 822 Mt, means this works out to 36500 tonnes of Ga, enough to meet world demand for over 100 years. The project is reasonably advanced; a preliminary economic assessment was released in 2014.

The Alces Lake project (owned by Appia Rare Earth and Uranium Corp) in northern Saskatchewan, Canada doesn’t have established resources yet, but assays have returned up to 4657 ppm Ga, and the high-grade zone is said to range from ~70-700 ppm Ga. REE-galium mineralization at Alces Lake occurs in pegmatites and hydrothermal veins, with monazite ((Ce,La,Th)PO4), zircon, and allanite ((REE)(Al,Fe)(SiO4)3(OH)) being the ore minerals. These pegmatites and veins seem to have formed during high-temperature metamorphism, which partially melted rocks in the area.

US Critical Materials Corp has reported up to 1370 ppm Ga in its’ early-stage Sheep Creek project in Montana. Surfaces samples averaged 93 ppm Ga and 5% total REE, although pockets of higher grade (~300 ppm) Ga also occur. REE-gallium-niobium mineralization occurs in carbonatites, a rare igneous rock dominated by carbonate minerals, which can also contain a variety of rare minerals. At Sheep Creek the main REE, and presumably Ga, mineral is allanite.

Banded carbonatite enriched in Ga and REEs exposed in a historic adit from the Sheep Creek project.

My own research on MIAC deposits has also turned up hydrothermally altered pegmatites enriched in Ga up to 167 ppm. The gallium here seems to be associated with magnetite (Fe3O4) formed via Iron-Oxide-Apatite (IOA) mineralization.

Some coal deposits have been suggested as potential Ga resources. Most of these are located in northern China and contain relatively low levels (~30 ppm) of gallium.

Critical Questions

While gallium deposits are extremely rare, they do seem to exist. The question is whether these are unicorns, i.e. vanishingly rare deposits formed through processes unlikely to be repeated, or if they are the tip of the iceberg, with many more waiting to be found. So where should we start looking?

So far, we’ve seen gallium in supergene sulfide deposits, low-sulfidation epithermal deposits, IOAs, and three different types of REE deposit. It’s a rather confusing mix of apparently unrelated deposit styles.

In the case of Apex and Cordero, as well as conventional gallium-bearing bauxite deposits, the common thread seems to be leaching. Extensive interactions between host rocks and near-surface waters stripped out many of the original constituents of the rock, leaving gallium, which is not easily dissolved in fluids, concentrated in the residual. It makes sense for gallium to turn up in iron-oxide minerals, as Ga ions are very similar to oxidized iron. This could partially explain it turning up in an IOA, although the fact that this hasn’t been reported elsewhere suggests there’s still a missing piece or two.

The case of Ga-REE deposits is less certain. Round Top, Alces Lake, and Sheep Creek all formed from REE rich, alkaline magmas, and may have been further enriched by hydrothermal fluids. How gallium fits into this picture is unclear; most REE deposits don’t report any gallium, so what makes these few deposits special?

The first step will be understanding the mineralogy of gallium. Not only would this help us narrow down where we should start looking, it may be critical to deciding what is economically viable.

So far gallium has only been extracted from oxide and sulfide minerals, which tend to be easier to process than the complex carbonate/phosphate/silicate ores in most REE deposits. Many high grade REE projects aren’t economic because breaking down the host minerals is too expensive or produces too many toxic byproducts. In the case of monazite-rich ores, such as Alces Lake, the concentration of radioactive thorium in this mineral often produces radioactive wastes which can be costly, and controversial, to manage. Little information is available on the nature of gallium in Round Top.

Without knowing the mineralogy it’s difficult to define what ore grade for gallium even is. US Critical Materials claims extraction is profitable at 50 ppm Ga; cutoff grade at Cordero was 30 ppm. These may not hold true elsewhere.

Another issue with many of these potential gallium deposits is that most of their value would still come from other commodities, mainly REEs. As long as gallium remains a byproduct they won’t necessarily ensure a stable supply.

The price of gallium has experienced several sharp increases in recent years due to supply disruptions.

Investor Takeaways

Despite its obscurity, gallium is one of the most threatened critical elements. It is produced only as a byproduct of bauxite and, to a lesser extent zinc, mining, and has seen significant price fluctuations and recent rapid increases driven by geopolitical issues. While there are a number of promising gallium projects in North America, these are mostly at early stages, and significant knowledge gaps remain. Like many other critical elements, breaking China’s stranglehold on supply chains will require years of investments in understanding the geology, chemistry, and economics of extracting this rare resource.