Australia: The Next Frontier in Rare Earths

By now, you’ve probably heard of China’s dominance in the production of strategically important rare earth elements (REEs). Recently Australia has emerged as the world’s fourth largest producer or REEs, and, with a slew of new REE projects and discoveries, it may be poised to challenge China’s status as the world’s undisputed REE heavyweight.

Rare Earths

Rare earths are a group of elements clustered along the bottom of the periodic table, with the chemically similar elements yttrium (Y) and scandium (Sc) often included. Despite the name, the rarity of these elements varies widely, with the most common, cerium, being about as common in the earth’s crust as copper, while the rarest, lutetium, is more than 80 times less abundant. The light rare Earths (LREE) are far more common, and less valuable, than the heavy rare earths (HREE).

REEs are often divided into more common light REEs and rarer heavy REEs.

REEs are essential for many high-tech devices, from the screens in smartphones to the magnets in wind turbines and electric vehicles to the guidance systems in missiles. A secure supply of these economically and strategically vital metals has proved hard to establish; deposits are relatively rare and ore processing is difficult, expensive, and often environmentally destructive. For the past two decades China has produced >80% of global supply. This near monopoly has allowed China to use REE supplies as geopolitical leverage in trade disputes, spurring efforts to diversify production.

Rare Earth Deposits

Nearly all known REE deposits are associated with rare types of magmatism. Most of the world’s resources are hosted within, or are closely associated with, alkaline igneous rocks or carbonatites, as well as heavy mineral sands formed by eroding these rocks. This lack of diversity creates challenges for mining. Alkaline rocks host most of their REEs in silicate minerals which are difficult to impossible to economically process with current technology, while the more economically viable carbonatite deposits are rich in LREEs but very poor in the more sought-after HREEs. Much of the world’s HREEs come from ionic-absorption clay deposits which form when REE-rich granites weather in tropical climates. These deposits are almost exclusively found in southeast Asia (mainly China) and contain relatively modest resources which are being rapidly depleted. In the long run there are plenty of LREEs to go around, but the same might not be true of HREEs.

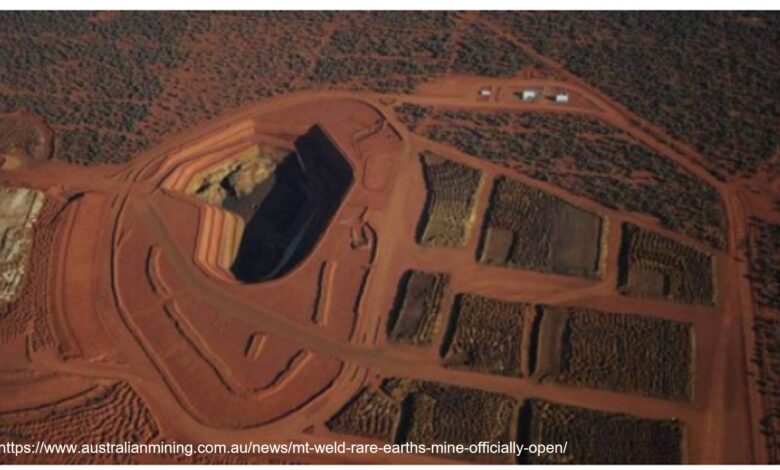

Mt Weld

Mt Weld, Australia is one of the world’s largest and highest-grade REE deposits, with proven and probable reserves of 19.7 Mt at 8.6% total rare earth oxides (TREO), and measured, indicated, and inferred resources of 55.4 Mt at 5.4% TREO. Mine life is estimated to be at least 25 years. Currently, only the Central Lanthanide Deposit is mined, however the project also hosts the undeveloped Duncan (REE), Crown (niobium, tantalum, titanium, REE, zirconium) and Swan (phosphate) deposits. The project is owned by Lynas Rare Earths Corp.

The open pit at Mt Weld.

Mt Weld produces 66 Kt/year of REE concentrate, which is shipped for processing at Lynas’s processing plant in Malasia. This plant has been controversial due to production of radioactive wastes; however the Malaysian government recently renewed its’ operating license. Lynas is currently constructing a new processing plant in Australia, although this will be a supplement rather than a replacement for overseas processing.

Mt Weld is a 2-billion-year-old carbonatite, a rare igneous rock consisting of >50% carbonate minerals, which has been deeply weathered. This weathering has upgraded the already REE-rich carbonatite into one of the highest-grade deposits in the world, while also making the deposit easier to mine by breaking down the once solid ore. Like most carbonatites, Mt Weld produces mainly LREE, although some HREEs are present.

Olympic Dam

Olympic Dam, South Australia, is best known as one of the world’s largest copper, gold, silver, and uranium mines. Like many Iron-Oxide-Copper-Gold (IOCG) deposits, Olympic Dam also hosts low-grade REE (mainly LREE) mineralization. Given the enormous size of the deposit, this makes Olympic Dam one of the largest REE deposits in the world, with resources of ~2000 Mt at 0.5% REO. The project is owned by BHP Billiton.

Currently, REEs are not recovered at Olympic Dam. There have been many proposals to recover REEs as a byproduct, although this would require substantial investment in new processing facilities and seems unlikely to occur anytime soon, especially given that most of these are the low-value LREEs lanthanum and cerium.

Eneabba

Iluka Resources, which has primarily been a producer of mineral sands, plans to enter the REE business by constructing a nearly $1.5 billion REE refinery at its’ Eneabba project in Western Australia. The refinery is expected to process 17.5 kt/year REO by 2025. Iluka has secured a $1.25 billion loan from the Australian government to finance construction.

The plant will initially process Iluka’s stockpiles of REE-bearing mineral sands, which has an expected lifetime of 10 years, but is designed primarily to process feedstocks from other projects. Eneabba may also process REE sands from Iluka’s Wimmera Project in Victoria, Australia.

Yangibana

Earlier this year Hastings Technology Metals secured a $100 million government loan to begin developing its’ $500 million Yangibana Project, Western Australia. Proven and probable reserves stand at 10.35 Mt at 1.22% TREO, with measure, indicated, and inferred resources of 21.67 Mt at 1.17% TREO. The mine will be focused on the more desirable LREEs neodymium and praseodymium. Hastings has signed memorandums of understanding to export 6 Kt/year of REE concentrate for processing in China. It would be Australia’s second largest REE producer behind Mt Weld.

Mineralization in Yangibana consists of many narrow 1.3-billion-year-old dykes of ironstone associated with carbonatite, with most of the REEs hosted in the mineral monazite.

Hastings also owns the Brockman Project, Western Australia, which hosts 52 Mt at 0.22% TREO (with 85% being HREEs), plus 0.39% niobium oxide and 0.95% zirconium oxide.

Dubbo

Australian Strategic Metal’s (ASM) Dubbo Project in New South Wales hosts proven reserves of 18.9 Mt at 0.871% TREO, plus 1.85% zirconium oxide, 0.04% hafnium oxide, 0.440% niobium oxide, and 0.029% tantalum oxide, with measured and inferred resources of 75.18 Mt at 0.88% TREO plus 1.89% zirconium oxide, 0.04% hafnium oxide, 0.44% niobium oxide, and 0.03% tantalum oxide. This makes it a world class rare metals deposit. The project is preparing to begin construction, with expected production of 1 Mt/year from an open pit; mine life is expected to be at least 20 years. A processing facility is expected to be constructed in South Korea.

The deposit consists of a sill of a subvolcanic alkaline rock called trachyte. Ore minerals are a variety of silicates, carbonates, and oxides; despite this complexity ASM believes the ore can be processed relatively easily.

Browns Range

A number of REE deposits have been discovered in recent years in the Browns Range area of northern Australia. The largest of these is the Wolverine deposit, owned by Northern Minerals, which has resources of 4.97 Mt at 0.86% total REEs. While this wouldn’t normally be very impressive, the high proportion (89%!) of HREEs + Y makes Wolverine an unusual and exciting discovery. Northern Minerals has completed a pilot processing plant and is currently exploring for more near-surface resources at Wolverine and surrounding deposits to increase potential mine life.

Ore in Wolverine, like other deposits in the area, consists of 1.65-1.60-billion-year-old quartz-xenotime veins and breccias hosted in steeply dipping fault zones.

REE ore breccia from the Wolverine Deposit. Abbreviations: BRM = Browns Range Metamorphics (host rock), Xnt = xenotime, Qtz = quartz, Hem = hematite.

The Browns Range deposits appear to be a completely new type: unconformity-related REE deposits. Unlike most REE deposits, these have no known link to magmatic processes; they are hydrothermal in origin. Hydrothermal REE deposits are very unusual because REEs are normally very hard for fluids to transport.

Fluids involved in the Browns Range deposits seem to have been unusually acidic and rich in chlorine and fluorine, enabling them to leach REEs from metasedimentary rocks. It’s uncertain how these ore-forming fluids became so much richer in HREEs than LREEs. These REE-bearing fluids then infiltrated fault systems, allowing them to cross the unconformity separating the metamorphic rocks from the overlying sedimentary rocks. This triggered ore deposition due to mixing with a phosphorous-rich fluid derived from the overlying sandstones. Phosphorous is highly reactive with REEs and will trigger the formation of minerals such as monazite and xenotime.

Illustration of how the Wolverine Deposit formed.

Overall, this process is very similar to unconformity-related uranium (U) deposits, and indeed the only other known similar deposit, the Maw Zone, is associated with unconformity U deposits in the Athabasca Basin, Canada.

Investor Takeaways: Are we reaching the end of Chinese REE Dominance?

China still dominates global REE production, accounting for 60-80% in 2021 (the uncertainty is due to illegal and undocumented mining). This, however, is down from a decade ago when it produced ~95%. Australia, on the other hand, has gone from 0% to 7% in the same time, and could be producing as much as 30% of global REEs in the next few years. America has also reemerged as a major producer with the reopening of the Mountain Pass mine in California. The Chinese government seems to have taken notice: they have been accused of using market manipulation and misinformation campaigns to undermine foreign producers.

Australian REE production has increased significantly over the last decade.

The discovery of HREE-rich deposits may prove very significant, as until recently there seemed to be very few alternative sources of these rare elements. Whether these unconventional deposits can be successfully developed remains to be seen. Although some of these Australian projects are years out from production, the discovery of so many potentially viable deposits of different types, and accompanying major investments in domestic processing facilities, signals exciting times may be ahead for REE mining in Australia.

- Fieles, N. (2022): Australia backs rare earths mine to reduce China’s supply dominance. Financial Times. Retrieved from: https://www.ft.com/content/552274c4-221a-49ac-91dd-562c51655e76 (news article).

- Coyne, J. (2022): Rare earths in Australia must be about more than mining. The strategist. Retrieved from: https://www.aspistrategist.org.au/rare-earths-in-australia-must-be-about-more-than-mining/ (news article).

- Nazari-Dehkordi, T., Spandler, C., Oliver, N. H. S., and Wilson, R. (2018): Unconformity-Related Rare Earth Element Deposits: A Regional-Scale Hydrothermal Mineralization Type of Northern Australia. Economic Geology, v. 113, no. 6, pp. 1297–1305. (academic article).