Standard Uranium: Wheeling and Dealing in the Basin

The life of a junior miner is a bit like the life of a gambler: to survive any length of time you have to know when to hold ‘em, when to fold ‘em, when to walk away, and, occasionally, when to run. Some, however, find ways to make their own luck. Standard Uranium shows how this can be done.

Standard Uranium

A map of Standard Uranium’s properties in the Athabasca Basin.

Standard holds an interest in 13 properties in northern Saskatchewan, Canada’s Athabasca Basin. The Athabasca is the best place in the world to chase the ultimate jackpot: unconformity uranium deposits. These form when uranium-bearing hydrothermal fluids cross the unconformity separating a sedimentary basin from the igneous or metamorphic rocks below, leading to chemical reactions between the fluid(s) and the new rock type which cause the uranium to be deposited. They can be found in the sedimentary rocks (basin-hosted) or in the basement rocks (basement-hosted) below.

Tonne-for-tonne unconformity uranium ore can be the most valuable rock on Earth. Uranium ore in Cameco’s Cigar Lake Mine is worth ~$25422 per tonne at current uranium prices; >250 times higher than many large open-pit operations. The catch is that finding these ore bodies is tremendously difficult.

Between thick blankets of glacial till covering the area and the fact that uranium is highly soluble in surface water and tends to be dissolved away, surface prospecting is largely ineffective in the basin. You might think a radioactive ore body would be easy to locate with a Geiger counter, but even a few meters of rock or dirt are enough to completely hide this signature. The graphite-lined faults which host most unconformity deposits show up clearly, but there are many such faults, most of which don’t host any ore. The only way to find out is to drill. Unconformity deposits are surrounded by an envelope of clay, hematite, and dravite (tourmaline) alteration, but these don’t always contain uranium either. A hole that hits alteration could be meters away from ore, or nowhere near it. The only way to find out is to keep drilling.

Over the years Standard has drilled a lot of holes. They’ve encountered anomalous radioactivity many times, providing proof of concept, but none of these have been enough to take to the bank. Drilling, especially in the remote Athabasca Basin, is expensive. Experienced investors, and gamblers, know that anteing up, and patience, is part of the game; but they also know that sooner or later you need to start winning hands or start walking away.

The House Always Wins

Rather than keep rolling the dice, Standard opted for a strategic pivot in June 2023. Leveraging its then portfolio of six projects totaling >65000 hectares, Standard transitioned from a purely exploration business model to a project generator model. Instead of just playing its cards, Standard would now deal them as well.

Since October 2023 Standard has signed four definitive option agreements with other uranium explorers. The first was the sale of the Sun Dog Project on the northeastern edge of the Athabasca Basin. Sun Dog contains the historic Gunnar uranium mine, which mined 18 million lbs U3O8 from lower grade Beaverlodge-style vein deposits from 1953-1982. Standard completed 2469 m of drilling on the property in 2022-23, encountering significant alteration and radioactivity in several holes.

Map of the Sun Dog Project. The area’s many past-producing mines targeted smaller vein-style deposits, but Standard believes the area harbors much larger unconformity-style deposits as well.

Under the agreement the optionee, 1443904 B.C. Ltd (which has since been acquired by Aero Energy), must pay Standard $650 000 in cash, $650 000 in shares, and incur $6 500 000 in exploration expenses at Sun Dog over three years. Standard will retain a 2% NSR royalty, half of which can be purchased by the optionee at any time before commercial production for $1 000 000. As an added sweetener, Standard will conduct the exploration work subject to an operator fee of 10%, allowing Standard to pocket another $650 000 over three years.

Structure of the sale of the Sun Dog project.

In late 2023 Sun Dog was integrated with the nearby Murmac and Strike projects into a larger Uranium City project under the ownership of Aero Energy, formerly Angold.

Standard has also optioned its Atlantic, Canary, and Brown Lake projects to ATCO Mining, Mamba Exploration Ltd, and Mustang Energy Corp, respectively. The numbers vary, but the general structure of these deals is similar: the optionee pays a few hundred thousand dollars, plus a comparable value in shares, and millions in exploration expense commitments, often with Standard receiving a 10-12% fee as the exploration operator. In the case of Brown Lake, payment will be in the form of shares and operator fees only. These deals generally occur in stages over 3 years, with the optionee acquiring a 75-100% interest upon completion. In all cases Standard retains at least a 1% NSR royalty.

Standard has another 7 projects available for option, with new projects being actively staked. Standard also retains their flagship Davidson River project, which they plan to continue exploring themselves. Davidson River is located just outside the margin of the Athabasca Basin, 25-30 km west of the most significant recent discoveries in the basin, the Arrow and Triple R projects (owned by NexGen Energy and Fission Uranium, respectively). The property contains four conductive corridors associated with favorable structural trends and clay-dravite alteration, indicating they are prospective for unconformity uranium deposits.

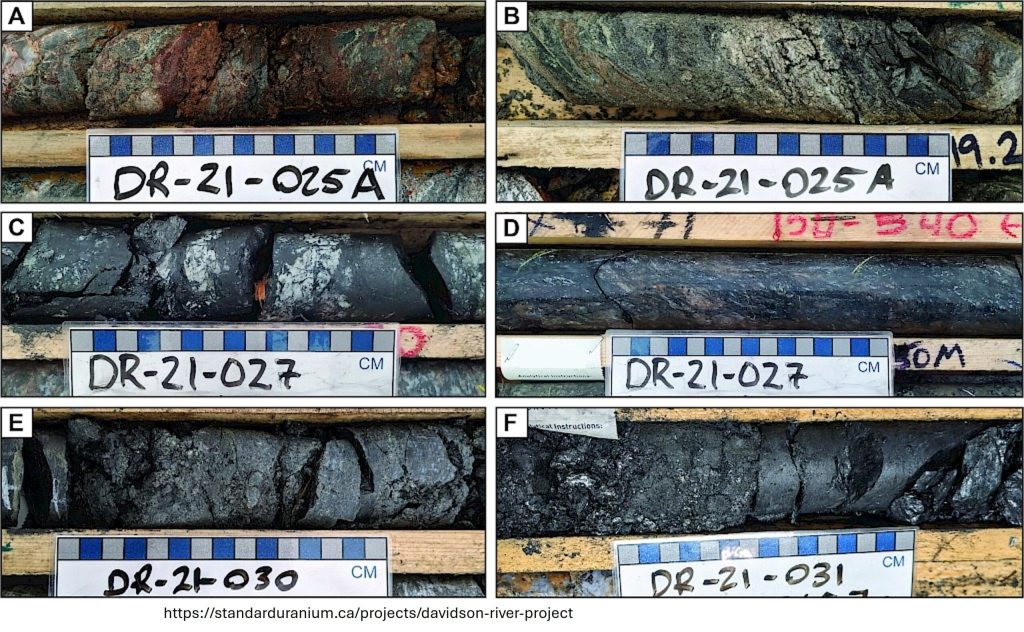

Drill core with hematite-clay-dravite alteration and graphitic structures from the Davidson River project.

Right time, Right play

The new project generator model allows Standard to raise capital, establish a steady revenue stream, and reduce risk while still keeping an interest in potentially lucrative projects. Instead of leaving the table, Standard found a way to turn the tables and become the house. This move echoes the savvy businesspeople of the gold rush who ‘mined the miners’ by selling much needed supplies to the newly arrived prospectors. This often proved to be a much more profitable route than trying to strike it rich in the hills.

Assuming all stages of the four signed deals are completed, Standard stands to make at least $4.3 million over three years, plus 60,000 shares of Mustang and 15,000,000 shares of ATCO Mining (currently worth ~$23 000 and $300 000, respectively). Standard has also been successful in raising millions more in private placement offerings over the past year; much of this is earmarked for the Davidson River project.

Of course, Standard does lose out on the opportunity to own 100% of the next great mine, but even a small piece of a multi-billion-dollar operation is a big win for a small company, especially considering how few projects go on the become mines, and the enormous amount of capital and time that is required to open a new mine these days.

Standard’s model is already paying dividends; surface prospecting at Sun Dog has returned assays up to 13% U3O8, with numerous promising targets still to explore. Unsurprisingly, Aero has committed to the second stage of its option for the Sun Dog project, ensuring another hundreds of thousands of dollars in cash and shares for Standard.

Standard’s portfolio is also revealing of broader trends in the Athabasca Basin. Many of these properties are actually outside of the basin, reflecting the new understanding that basement-hosted unconformity deposits could also be found beyond the basin itself. Over a billion years of erosion has shrunk the size and thickness of the basin and may have helped expose any deposits which originally formed in the basement below it. Vein-type uranium deposits, which tend to be smaller and lower-grade than unconformity deposits but may still be economically viable, can also be found in these basement rocks, particularly in the Beaverlodge area near the Sun Dog project. There’s a hell of a lot of ground to cover, and almost certainly more big deposits to find out there. Standard isn’t likely to run out of projects to wheel and deal anytime soon.

Times are also good for uranium more broadly. The price of uranium has increased from barely $25/lb in 2020 to $80-100/lb throughout most of 2024. The rise is due to a number of factors; many long-term uranium contracts have been running out, allowing miners to negotiate better deals following many years of depressed uranium prices. The nuclear industry, the sole buyer of uranium, has also been going through a revival in recent years. The need for stable, carbon free electricity has spurred a wave of investments from governments and private industry. Notably, the vast power needs of AI has seen tech companies like Amazon, Google, and Microsoft making direct deals with nuclear operators, leading to the planned reopening of the Three Mile Island nuclear plant; the first time a closed plant has been revived.

Investor Takeaways

Standard Uranium’s new business model allows it a great deal of flexibility to bring in revenue from buying and optioning properties, while still exploring its core projects. With a large portfolio of early-stage projects Standard is well positioned to take advantage of strong and growing tailwinds for uranium. Exploration is high risk, high reward by nature, but Standard shows that creative solutions can help manage the risk without giving up on the reward.